You can now add music to your photo carousels. With Collabs, you can now invite up to three friends to...

85 per cent scale recreation of 1929 4½-litre Supercharged Bentley created by The Little Car Company ‘Blower Jnr’ will be...

The largest ever study of the genetics of the brain – encompassing some 36,000 brain scans – has identified more than 4,000 genetic variants linked to...

A new mood of dark glamour takes hold with H&M Studio’s A/W23 collection. Inspired by fashion’s taste for the thrilling simplicity of black coupled with silhouettes...

A new research project has been launched to help businesses understand and improve their cyber security and streamline access to targeted support. Experts from the University...

LC-first Polar Surge Satin exterior and Deep Blue interior color combination Standard 21-inch matte black forged wheels Limited to 125 units in North America MSRP including...

All-new Adobe Express with Adobe Firefly beta is now ready for general availability Express makes it fast, easy and fun for users across all skill levels...

Capitalising on the success of its Dolce & Gabana pop up store, Qatar Duty Free has increased the brand presence at HIADoha, Qatar – Qatar Duty Free...

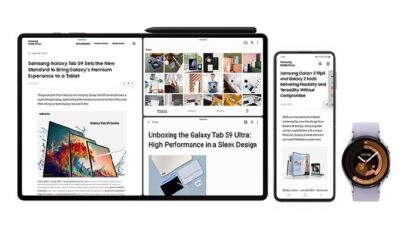

Samsung’s update is set to bring more users heightened convenience across the entire Samsung Galaxy ecosystem. Samsung is bringing select features from the latest One UI...

Findings may demonstrate a brain and behavioural basis for how nicotine addiction is initiated and then takes hold in early life, say scientists. Levels of grey...

Continuing BAPE®’s 30th anniversary celebrations, adidas Originals and the iconic Japanese brand present the highly limited Forum 84 BAPE® Low Triple-White sneaker. In commemoration of the...

Visa (NYSE:V), a global leader in digital payments, and Conferma Pay, the world’s foremost providers of virtual payments technology, announced an extension of their strategic collaboration...